Aytyapi Insights

Exploring the latest trends and updates in technology and lifestyle.

Insurance Showdown: Finding Your Perfect Match

Discover the ultimate guide to finding your perfect insurance match and unlocking the best deals! Don't settle, explore now!

Understanding Different Types of Insurance: Which One is Right for You?

Understanding the different types of insurance available can be overwhelming, but it's crucial for making informed decisions about your coverage needs. The main categories of insurance include health insurance, auto insurance, homeowner's insurance, and life insurance. Each type serves a distinct purpose:

- Health Insurance: Covers medical expenses and can protect you from high healthcare costs.

- Auto Insurance: Offers financial protection in case of accidents, theft, or damage to your vehicle.

- Homeowner's Insurance: Safeguards your home and personal property against damage or loss.

- Life Insurance: Provides financial support to your loved ones in the event of your passing.

When selecting insurance, consider your individual needs and circumstances. Ask yourself key questions such as:

- What assets do I need to protect?

- What are my health needs?

- How many dependents rely on my income?

Key Questions to Ask When Shopping for Insurance Policies

When shopping for insurance policies, it's crucial to ask the right questions to ensure you make an informed decision. Start by considering your specific needs: What type of coverage do I require? This will vary depending on your circumstances, whether it’s auto, home, health, or life insurance. Additionally, inquire about the policy limits and deductibles, as these factors can significantly impact your premium and out-of-pocket costs. A clear understanding of these aspects will help you compare options more effectively.

Another key area to explore is the insurer's reputation. Ask questions such as: What is the company’s claims process? and How quickly do they typically pay out claims? Reading customer reviews and ratings can provide insight into others' experiences with the insurer. Furthermore, consider asking about discounts and bundling options to optimize your budget. By gathering comprehensive information through these questions, you can make a well-rounded decision when selecting your insurance policy.

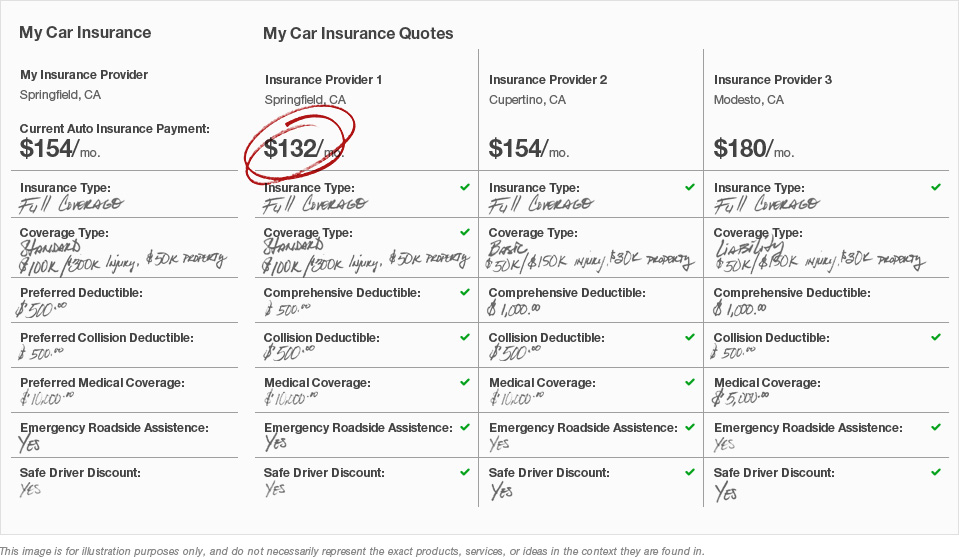

Comparing Insurance Providers: What to Look For in Your Perfect Match

When comparing insurance providers, it's essential to identify key factors that align with your individual needs. Start by evaluating the coverage options each provider offers. This includes understanding the types of policies available, the extent of coverage, and any exclusions that may apply. Additionally, consider the premium costs and whether they fit within your budget. Don’t overlook customer service ratings and reviews, as these are vital in ensuring a smooth claims process when the time comes.

Another critical aspect to examine is the financial strength of each insurance company. You want a provider that can fulfill its obligations, particularly in times of need. Look for ratings from independent agencies that assess the financial stability of insurers. Finally, check for any discounts or bundling options that could provide additional savings. By taking the time to compare these elements, you’ll be well on your way to finding your perfect match in the insurance market.