Aytyapi Insights

Exploring the latest trends and updates in technology and lifestyle.

Whole Life Insurance: Your Financial Safety Net with a Twist

Discover how whole life insurance can be your unique financial safety net—protect your future in unexpected ways!

Understanding Whole Life Insurance: A Comprehensive Guide

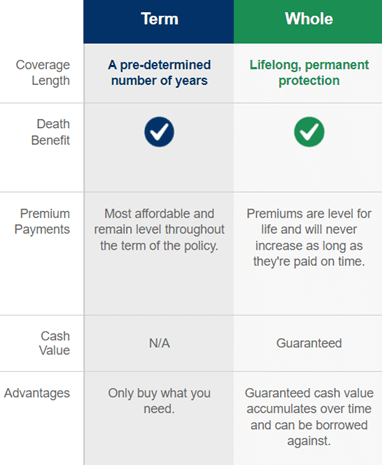

Whole life insurance is a popular and vital component of financial planning. It offers lifelong coverage, provided premiums are paid, and accumulates cash value over time. Unlike term life insurance, which only covers you for a specific period, whole life insurance provides a death benefit to your beneficiaries at any point in your life. This can be a valuable financial resource for your family, ensuring financial security during challenging times. Understanding the nuances of whole life insurance can be daunting, but it is crucial for making informed decisions. For more detailed information, check out this Investopedia article on whole life insurance.

When considering whole life insurance, it's essential to be aware of its features, benefits, and potential drawbacks. The premiums for whole life policies are typically higher than those of term life policies due to the lifelong coverage and cash value component. However, the cash value grows at a guaranteed rate and can be borrowed against or even withdrawn in certain situations, making it a unique investment tool. It's important to conduct thorough research and possibly consult a financial advisor to determine if whole life insurance aligns with your financial goals. For additional insights, visit NerdWallet's comprehensive guide.

Top 5 Benefits of Whole Life Insurance You Didn't Know About

When considering whole life insurance, many people are aware of the basic benefits such as lifelong coverage and cash value accumulation. However, there are several other advantages that often go unnoticed. For example, whole life insurance policies offer a guaranteed death benefit, which means your beneficiaries will receive a predetermined amount regardless of when you pass away. This can provide unparalleled peace of mind. Additionally, the cash value portion of the policy grows at a consistent rate, allowing you to borrow against it if financial emergencies arise. To learn more about this aspect, check out Investopedia.

One of the most significant but lesser-known benefits of whole life insurance is its role in estate planning. The cash value can be used as a tool to pay estate taxes, helping to preserve your heirs' inheritance. Furthermore, whole life insurance can provide dividends to policyholders, which can be reinvested to increase the cash value or taken as income. This creates an investment component that can outperform other savings vehicles. Ready to dive deeper into the benefits? Visit The Balance for a comprehensive overview.

Is Whole Life Insurance Right for You? Key Questions to Consider

Whole life insurance can be a valuable financial instrument, but is it right for you? Before making a decision, consider key questions that can help assess your needs. First, evaluate your financial goals: Are you looking for coverage that lasts your entire life, or do you need a temporary solution? Additionally, think about your current budget. Whole life policies often come with higher premiums compared to term life insurance. A budgeting analysis may reveal whether the benefits of whole life, such as cash value accumulation, suit your long-term financial vision. You might also want to review resources such as Investopedia for a comprehensive understanding of whole life insurance.

Next, consider your age and health status, as these factors play a significant role in your whole life insurance costs. Are you in good health and planning to live a long, full life? This could make whole life insurance more attractive due to its lifelong benefits. Furthermore, think about your dependents: Do you have children or a partner who relies on your income? Whole life insurance can provide financial security for them in the event of your passing. For a deeper dive into the advantages and disadvantages of whole life policies, check out NerdWallet.