Aytyapi Insights

Exploring the latest trends and updates in technology and lifestyle.

Insurance Policies: The Secret Life of Coverage

Unlock the hidden truths of insurance policies and discover how coverage can transform your financial future! Click to learn more!

Understanding the Different Types of Insurance Policies: Which One is Right for You?

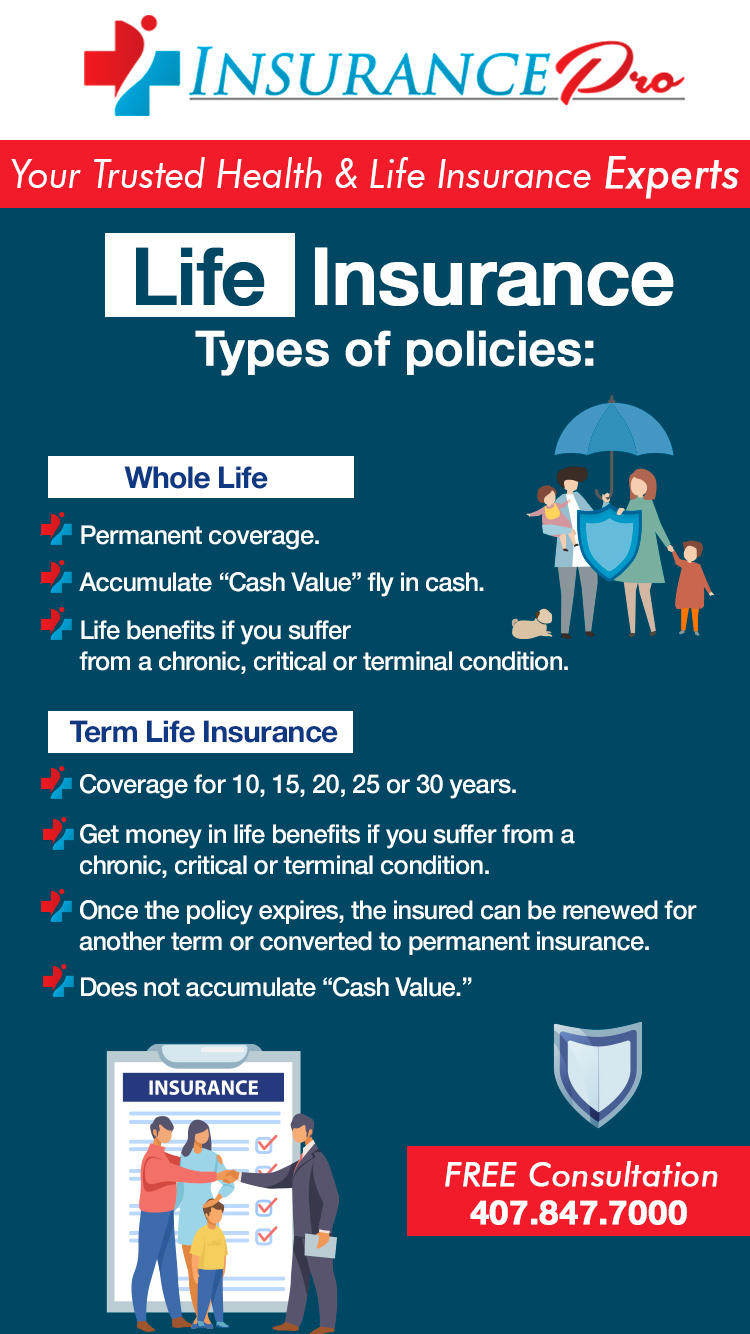

When it comes to securing your financial future, understanding the different types of insurance policies is crucial. Insurance can be broadly categorized into several types: life insurance, health insurance, auto insurance, homeowner's insurance, and disability insurance. Each type serves a specific purpose, ensuring that you and your loved ones are protected from unexpected events. For instance, life insurance provides financial support to your beneficiaries after your death, while health insurance helps cover medical expenses. Understanding these distinctions can help you make informed decisions about which policies suit your needs.

Choosing the right insurance policy depends on various factors, including your lifestyle, financial situation, and specific needs. To help you navigate this decision, consider these key questions:

- What are my primary financial concerns?

- How would I manage financially if I were unable to work due to illness or injury?

- Do I own valuable assets that require protection?

10 Common Myths About Insurance Coverage Debunked

Insurance is often shrouded in misconceptions that can lead to poor decisions and inadequate coverage. One common myth is that all insurance policies are the same. In reality, different insurance providers offer varied policies tailored to specific needs. For instance, health insurance can differ significantly between plans based on factors like deductibles, copayments, and coverage limits. It's vital to research and compare policies to find the coverage that best suits your situation.

Another prevalent myth is that you don’t need insurance if you’re young and healthy. Many young people believe they are invulnerable to accidents or medical emergencies, leading them to forgo insurance. However, unforeseen events can happen, and avoiding insurance can lead to financial devastation. According to the HealthCare.gov, having insurance can provide peace of mind and protect your finances. It’s essential for everyone, regardless of age or health, to have a plan in place.

How to Navigate the Fine Print: Key Terms You Need to Know in Your Insurance Policy

Understanding the fine print of your insurance policy is crucial for ensuring that you're adequately covered and not caught off guard during a claim. Before signing on the dotted line, take time to familiarize yourself with key terms and clauses that can significantly impact your coverage. Here are some essential terms to look out for:

- Deductible: The amount you must pay out of pocket before your insurance kicks in.

- Coverage Limit: The maximum amount your insurer will pay for a covered loss.

- Exclusions: Specific situations or events that are not covered by the policy.

For more detailed information on insurance terminology, you can visit Investopedia's Insurance Terms.

Another vital component to consider is the policyholder responsibilities. It's important to understand what actions you must take to maintain coverage and when your obligations may change. Always check for renewal terms as well, which dictate how and when your policy might be updated or renewed. Having a solid grasp of these terms will help you make informed decisions and avoid potential pitfalls. For further reading on navigating insurance policies effectively, refer to Consumer Reports.