Aytyapi Insights

Exploring the latest trends and updates in technology and lifestyle.

Offshore Banks: The Secret Garden for Your Cash

Discover how offshore banks can safeguard your wealth and unlock exclusive financial benefits—your cash deserves a secret garden!

Top 5 Benefits of Using Offshore Banks for Wealth Management

Using offshore banks for wealth management offers several compelling advantages. First and foremost, offshore banks provide enhanced privacy and confidentiality. Many individuals prefer to keep their financial affairs discreet, and offshore jurisdictions often have stringent privacy laws that protect the identity of account holders. This can be exceptionally beneficial for those looking to safeguard their wealth from potential scrutiny or legal challenges. In addition, offshore banks frequently allow for greater asset protection, shielding your wealth from local creditors and legal liabilities. Learn more about offshore banking benefits.

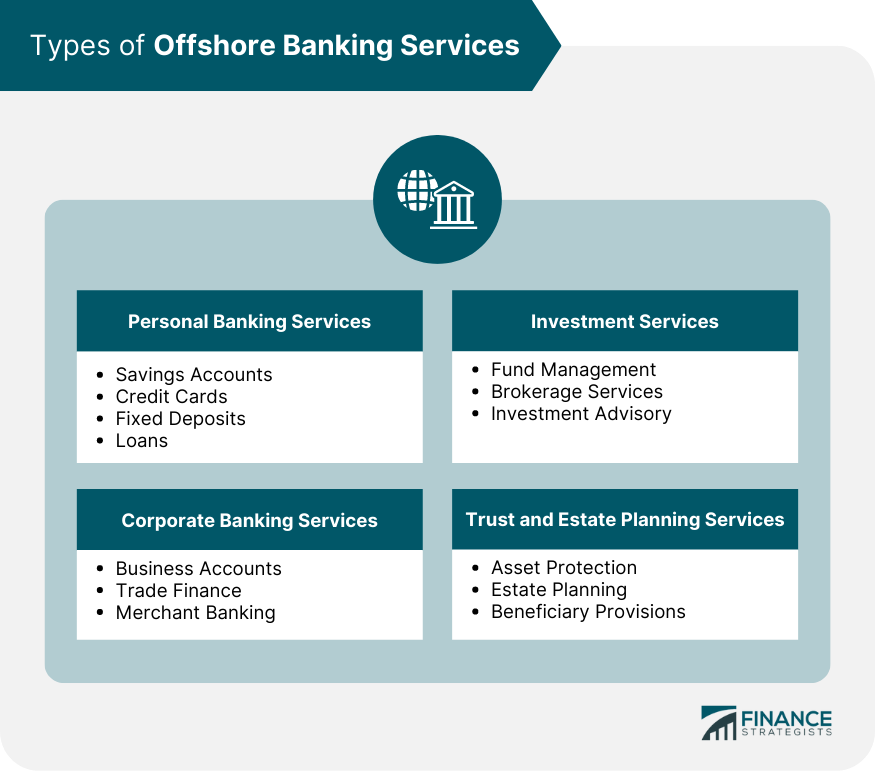

Another significant advantage is improved investment opportunities. Offshore banks typically offer access to a broader range of financial products, such as international stocks, bonds, and alternative investments that might not be available domestically. This diversification can help clients optimize their portfolios and enhance potential returns. Moreover, offshore accounts can often provide tax benefits, depending on the jurisdiction and the client's residency status. By strategically utilizing these options, individuals can maximize their wealth while minimizing tax liabilities. For additional insights on why offshore banks are favorable for investors, check this resource.

How to Choose the Right Offshore Bank for Your Financial Needs

Choosing the right offshore bank is a critical decision that can significantly impact your financial future. Offshore banking offers numerous advantages, including enhanced privacy, investment diversification, and potential tax benefits. However, before making a commitment, it's essential to evaluate several factors. Begin by researching the bank's regulatory environment and reputation; a bank located in a reputable jurisdiction can ensure better security for your assets. Additionally, consider the range of services offered, such as investment accounts, wealth management, and currency options, to find the best fit for your financial objectives.

Another crucial aspect to consider is the bank's fees and minimum deposit requirements. Different offshore banks have varying fee structures, which can affect the overall return on your investments. Comparing fees across multiple banks can help you determine which options are most cost-effective for your situation. Furthermore, check if the bank provides online banking services, as this could greatly enhance your banking experience and accessibility. Lastly, consult with a financial advisor experienced in offshore banking to receive personalized recommendations that align with your unique financial goals.

Are Offshore Banks Safe? Debunking Common Myths

When considering the safety of offshore banks, it's important to dispel some common myths that often lead to misconceptions. Many people believe that offshore accounts are inherently shady and used solely for tax evasion; however, this is not the case. In fact, reputable offshore banks operate under strict regulations and transparency guidelines in their respective jurisdictions. According to Investopedia, many offshore banking institutions are known for their robust security measures and high levels of customer service, making them a viable option for asset protection and wealth management.

Another prevalent myth about offshore banks is that they are only accessible to the wealthy elite. In reality, offshore banking services are available to a wide range of clients, including those with modest savings. Many banks offer low-cost options that cater to individuals seeking to diversify their investments or protect their assets from political instability and economic turmoil. According to The Street, utilizing an offshore bank can provide advantages, such as enhanced privacy and reduced risk, making them a sensible choice for those looking to secure their finances.