Aytyapi Insights

Exploring the latest trends and updates in technology and lifestyle.

Are You Throwing Money Away on Car Insurance?

Discover hidden savings on your car insurance! Are you overpaying? Find out now and keep your hard-earned money where it belongs.

10 Common Mistakes That Cost You Money on Car Insurance

Car insurance is often seen as a necessary expense, but many drivers inadvertently make common mistakes that can lead to higher premiums. One such mistake is failing to compare quotes from different providers. Many people stick with their current insurer out of habit, but shopping around can reveal better rates and coverage options. According to NerdWallet, it's essential to gather at least three quotes before making a decision. Additionally, not reviewing your policy regularly can mean missing out on discounts that insurers offer, such as low-mileage or safe-driver discounts.

Another costly mistake involves misunderstanding the terms of your policy. For instance, many drivers opt for lower premiums by choosing higher deductibles, which can backfire in the event of an accident. It's crucial to understand how your deductible affects your out-of-pocket expenses. Misreporting your vehicle’s usage or not updating your insurer about life changes, such as a new job or moving to a different state, can also influence your premium. Ensure you stay informed by checking resources like The Balance and adjust your policy accordingly to avoid these pitfalls.

Are You Overpaying? Signs You Need to Reevaluate Your Car Insurance

Many drivers are unaware that they may be overpaying for their car insurance, which can significantly impact their budget over time. If you haven't reviewed your policy in recent years, it might be time to take a closer look. Here are some clear signs that indicate you need to reevaluate your car insurance:

- Increased Premiums: If your premiums have steadily increased without any changes to your coverage or risk profile, it's time to investigate.

- Life Changes: Major life events such as a new job, moving to a different state, or changes in your driving habits can affect your rates.

Another aspect to consider is whether you qualify for any discounts. Many insurance companies offer savings for factors like being a safe driver or bundling policies. To ensure you're not overpaying, you should regularly compare quotes from various providers. Websites like NerdWallet can help you easily find competitive rates. Don't just assume your current policy is the best; take the time to explore your options to potentially save on your car insurance!

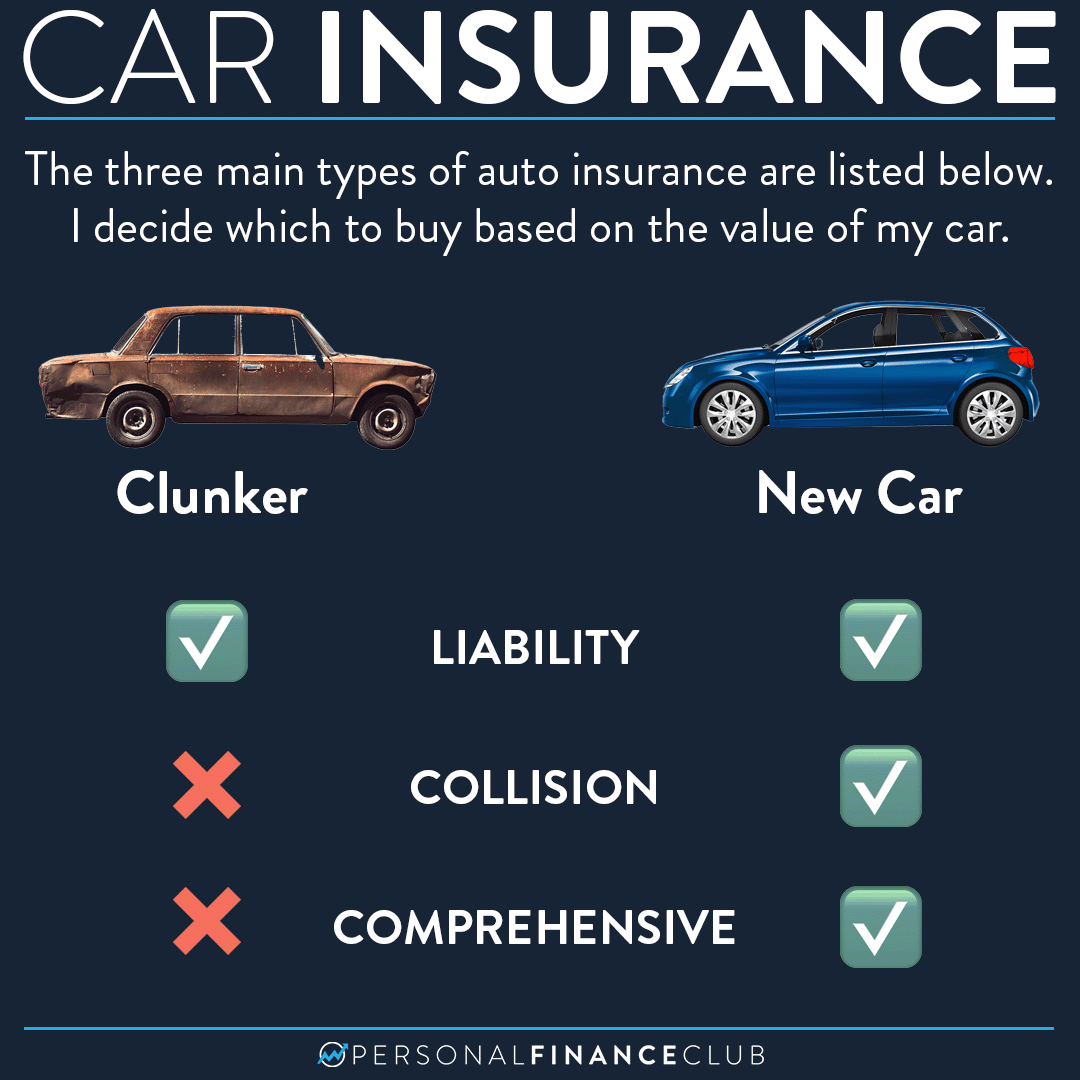

Is Your Car Insurance Policy Doing Enough? What to Look For

Your car insurance policy is more than just a legal requirement; it serves as your financial safety net in the event of an accident or theft. To determine if your policy is doing enough, start by evaluating your coverage types. Comprehensive coverage protects against non-collision-related incidents like theft, vandalism, or natural disasters, while liability coverage defends against claims made by others for bodily injury or property damage. It’s essential to ensure you have adequate limits on both types of coverage to fully protect your assets. For further guidance, check out Investopedia’s comprehensive guide on car insurance basics.

Additionally, it's crucial to assess any added features your car insurance policy might offer, such as roadside assistance or rental car reimbursement, which can enhance your driving experience and minimize out-of-pocket expenses. Review your deductibles as well; while a lower deductible means higher premiums, it can also mean more immediate relief after an accident. Don't hesitate to contact your insurance provider to discuss options that may better suit your needs and ensure your coverage is sufficiently robust. For an overview of deductibles and other important factors, visit MoneyGeek’s explanation of deductibles.