Aytyapi Insights

Exploring the latest trends and updates in technology and lifestyle.

Digital Asset Trading: Where Pixels Meet Profits

Unlock the secrets of digital asset trading! Discover how to turn pixels into profits and elevate your investment game today!

Understanding the Basics of Digital Asset Trading: A Comprehensive Guide

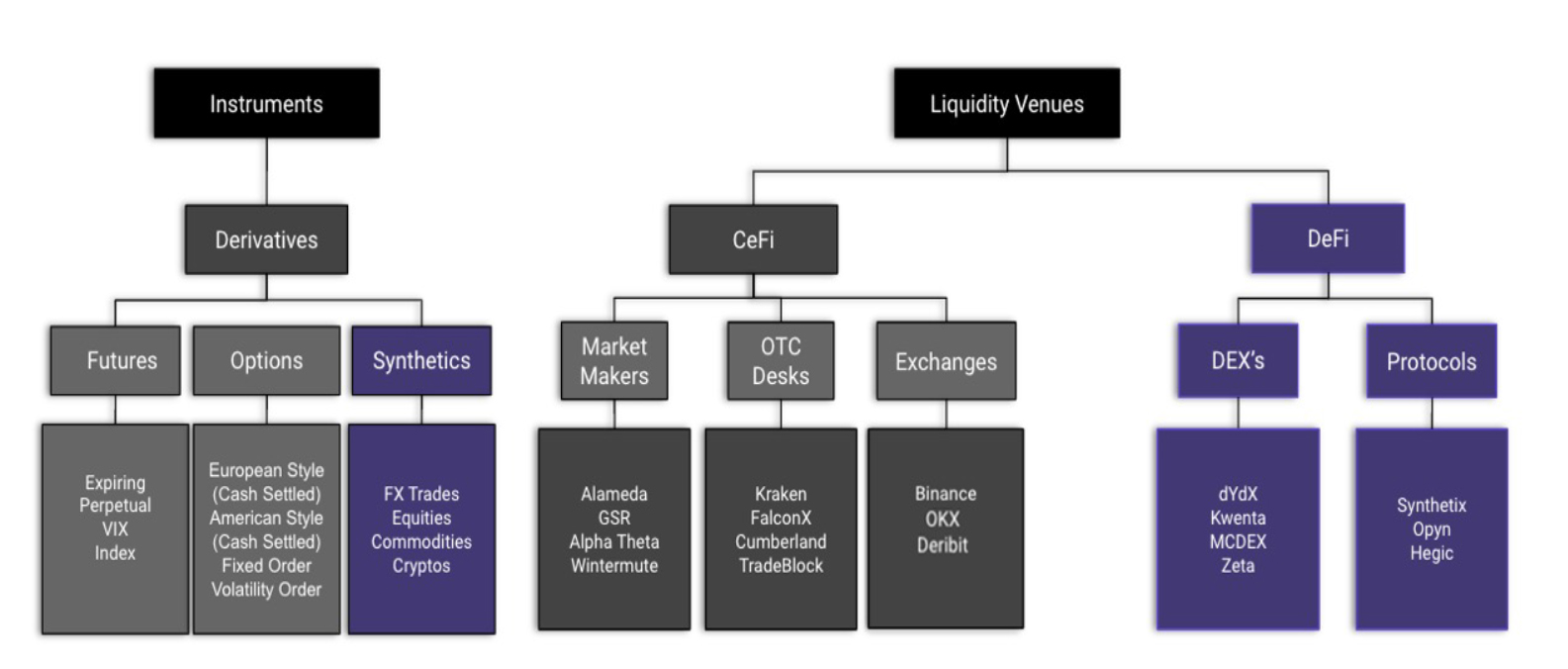

Digital asset trading is an evolving landscape that requires a solid understanding of fundamental concepts to navigate effectively. At its core, digital asset trading involves buying and selling digital assets such as cryptocurrencies, tokens, and other blockchain-based products via various online platforms. Key factors influencing these trades include market trends, trading volumes, and regulatory developments. To begin trading, it is essential to set up a secure digital wallet, choose a reputable exchange, and familiarize oneself with basic trading strategies, such as day trading and holding for long-term gains.

One crucial aspect of digital asset trading is the ability to analyze market conditions and make informed decisions. This can be accomplished through both fundamental and technical analysis. Fundamental analysis involves assessing the intrinsic value of a digital asset by examining factors like project utility, team background, and market demand. Meanwhile, technical analysis relies on historical price data and chart patterns to predict future movements. Traders should also consider diversifying their portfolios to mitigate risk, boosting their chances of success in this dynamic market.

Counter-Strike is a popular series of first-person shooter video games that emphasizes teamwork and strategy. Players can engage in competitive matches across various maps and game modes. If you're looking to enhance your gameplay, consider checking out the daddyskins promo code for some great in-game items.

Key Strategies for Maximizing Profits in the Digital Asset Market

In the rapidly evolving realm of digital assets, implementing key strategies for maximizing profits is essential for success. First and foremost, it is crucial to conduct thorough market research to identify trending digital assets that exhibit significant growth potential. Utilizing analytical tools, investors can track market trends and make informed decisions on which assets to trade. Moreover, diversifying your portfolio by investing in various digital assets—such as cryptocurrencies, NFTs, and tokenized assets—can help mitigate risks and enhance overall returns.

Another powerful strategy hinges on active trading techniques, such as day trading or swing trading, allowing investors to capitalize on short-term price movements. By setting clear entry and exit points, and employing stop-loss orders, traders can protect their investments while maximizing their profits. Additionally, staying informed about the latest regulatory changes and market news can provide valuable insights that contribute to better trading decisions. Ultimately, a well-rounded approach that combines research, diversification, and active trading can significantly boost profitability in the digital asset market.

What You Need to Know About NFTs: The Future of Digital Asset Trading

Non-fungible tokens, commonly known as NFTs, have emerged as a revolutionary force in the digital world, transforming how we perceive ownership and value. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, which are fungible and can be exchanged for one another, NFTs represent unique digital assets ranging from digital art to music, virtual real estate, and even tweets. The rise of blockchain technology has made it possible for creators to establish provenance and authenticity for their work, which is critical in a time when digital replication is effortless. As a result, NFTs have opened new avenues for artists and content creators to monetize their work, engaging audiences in unprecedented ways.

As you navigate the future of digital asset trading, it's essential to understand key aspects of the NFT landscape. Here are some crucial points to consider:

- Scarcity: Each NFT has metadata that certifies its uniqueness, creating scarcity and driving demand.

- Marketplaces: Platforms like OpenSea, Rarible, and Foundation have become go-to places for buying and selling NFTs.

- Smart Contracts: NFTs are created and enforced through smart contracts, ensuring the terms of ownership and transfer are clear and secure.